Thyme the Budgeting Assistant

Enhancing financial literacy among young people through an enjoyable and personalized approach to foster long-term financial well-being.

Thyme is a user-friendly budgeting app for high school to early-career individuals looking to expand their knowledge to better utilize their income. Through tailored experiences, intuitive budgeting, and fostering habits, Thyme aims to put young adults or teens, in control of their finances for long-term financial gain.

Role/Contribution

UX Designer/Lead the Slide Deck/Animator

Deliverables

Prototype, Brand Identity, & Pitchdeck

Duration

2 Months

Tools

Figma, Illustrator, Google docs & Qualtrics

The Team

Abigail Morales, Laura Rengifo, Kailyn Saltzman, & Arianna Michaud

"How might we motivate college students to improve their financial habits before they graduate college to create financial security in a personalized way?"

Upon selecting our focus, which centered on addressing financial budgeting challenges prevalent among young adults, particularly those in highschool, college or recent graduates, my team and I established a weekly timeline. This timeline was devised to ensure the progress of our work, outlining designated days for meetings with our professor and team discussions/work. The structured timeline served as a tool or guide to keep us on track, ensuring effective collaboration and progress monitoring throughout the duration of our project.

To ease ourselves into our chosen topic and establish a clear trajectory, we decided to create a quick and easy first survey with Google Docs. This survey was segmented into four distinct sections, collecting demographic information from both students and non-students. Furthermore, we delved into participants' opinions on budgeting and their experiences with budgeting apps. This initial survey played a pivotal role in laying the groundwork for our project, offering valuable insights that shaped the subsequent phases of our research and development as we moved forward.

We split research into two phases

Phase 1 //

After my team set roles for our research section, we looked into the 6 methods of budgeting, 3 academic readings, 3 competitive analyses, 5 literature reviews, and 4 secondary research. We learned...

Conventional budgeting comes with limitations

Traditional Budget

Base-year budget planning.

Time consuming, tedious, stagnant

50/30/20 Budget

Savings, spending, fun money

Not specific, can lead to overspending

Zero-Based Budget

Budgeting from a blank slate.

Rigid, long-term, intense tracking

Cash Flow Budget

Projected cash transactions

Not long term, constant monitoring

Envelope Budget

Divide in spending envelopes.

Requires cash, hard to manage

Percentage-Based Budget

Category percentage expense total

Requires adjustment and discipline

The three popular budgeting apps most people use

Mint, the most popular budgeting app

Won't exist after the end of 2023

Digit, simple ways to save

Can't transfer savings between goals

Good budget, digital envelope budgeting

Information overload

Moving forward, we initiated a brainstorming session to devise interview questions tailored for students (ages 18 and above only) and money management centers at various nearby universities. This process was informed by insights gained from our initial survey and research.

During our interviews, our emphasis was on understanding the common budgeting practices among students, their feelings regarding budgeting, and what experience and resources students receive at the money management centers provided by their university.

Students tend to fall in one of five categories

We successfully categorized the predominant types of budgeting approaches that individuals commonly adopt, with a significant number falling within the loose budget category.

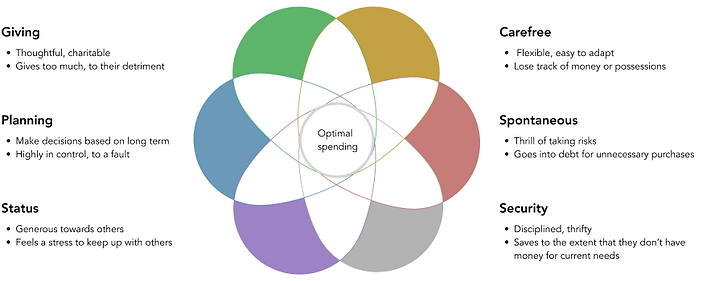

In order to achieve financial balance, aspects from all 6 personalities must be present

We unveiled six types of budgeting personality archetypes commonly observed among students. These distinct personality types serve a dual purpose: firstly, facilitating the identification of our users' specific budgeting orientations, and secondly, enabling us to tailor our strategies more effectively to meet their unique financial needs. This approach ensures a more nuanced and personalized engagement, addressing the diverse spectrum of budgeting preferences and behaviors within the student demographic.

The help provided by colleges falls short; University money management centers are limited in the amount of students they can serve

Pros

1. Informative

Offers a glossary of financial aid terms, offers financial literacy brochure, & offers a list of FAQs.

2. Available courses

Financial education center that helps students learn through different courses.

3. Easily accessible

Can be accessed through the campus website or a student's phone.

Cons

1. Very Casual

Instead of discussing your personal goals, you receive a pre-written speech from a peer, not an adult.

2. Unclear scheduling

Students may make speculative decisions about preferences, potentially overlooking more beneficial services.

3. All remote

The available appointment creation options appeared to be entirely virtual.

The effectiveness of university money management centers is influenced by factors such as limited awareness and inadequate marketing, potentially hindering student access. Mismatched services, lack of accessibility, and lack of personalization can compromise the impact of these centers. Overcoming challenges like insufficient staff training, limited integration with academic programs, and addressing financial literacy gaps is crucial for enhancing success. A comprehensive and student-centric approach, coupled with ongoing evaluation, is essential for meeting the diverse financial needs of students.

Problem:

Students/young adults are not financially literate, don't really have the best resources, and are stressed about finances in general.

Solution:

Our application needs to be educational, personalized, hands-on, flexible to accommodate changes in income, motivational, & visual.

Phase 2 //

Using Qaultrics, we developed a follow-up second survey building on insights from our initial research, gathering responses from over 80 participants across 11 states. The objective was to explore spending habits, saving preferences, life situations, family spending history, and motivators. The collected data was intended to guide our design, ensuring that our solution effectively supports our users with their budgeting, and improves their financial knowledge.

Obstacles and motivators that affect students and their budgets

Money can pose a significant obstacle for students due to various factors. Tuition fees, textbooks, housing, and other educational expenses can accumulate quickly, leading to financial strain. Additionally, students may have limited time for part-time employment while managing demanding academic schedules. Unexpected expenses or emergencies can disrupt budgeting plans, making it difficult for students to cover essential needs. As a result, financial constraints can impact students' well-being, academic performance, and overall college experience.

We noticed students are popularly motivated by factors such as money, fear, and relationships. The pursuit of financial stability and the desire for a comfortable future often drive students to excel academically and pursue high-paying career paths. Fear of failure or disappointment can also be a powerful motivator, pushing students to meet academic expectations and secure their desired outcomes. Additionally, relationships, both personal and professional, serve as motivational anchors, as students seek success not only for personal fulfillment, but also to contribute positively to the well-being of their families and communities.

Prototyping and creating our brand

Rapid iteration

We employed the Crazy 8's method to come up with multiple ideas at a fast pace. Each team member generated 25 different ideas aimed at visually and metaphorically guiding users toward effective budgeting and saving within our app. Following that, we constructed a feasibility matrix to assess and categorize these ideas. Prioritizing concepts residing in the green square, signifying the highest feasibility and user value, we honed down the selection to a final set of 40 ideas.

From those 40, our final idea was to create a budgeting app under Intuit that uses gamification to improve the way a young adult budgets their ever-changing income. Features like financial courses and lessons, customizable gardens that grow based on user's commitment to their budget, and local deals and discounts are all ideas included in the app.

Customer and onboarding journey map

In our journey maps, we illustrate the ideal user experience, starting with users recognizing the importance of budgeting and saving. Upon accessing our app, tailored to assist them in achieving financial goals, the ultimate objective is for users to share their newfound knowledge with friends and family, creating a positive impact beyond individual financial well-being.

Our branding/UI design

Our first choice of inspiration was going to be Mint by Intuit but after realizing it will no longer be in use after the end of 2023, we moved on to Credit Karma by Intuit for the remainder of the project. We created a vision board of the color palette, font face, and visual language Intuit utilizes as a means to go off of, but still made sure we did our own thing.

Art and animation

Our goals for the art were to create a memorable logo and mascot, visually showing the user's growth within the app, and to apply the color palette to our designs aiming for an appealing aesthetic. Additionally, we added little animations to create movement. All of these were geared towards fostering a distinctive and visually engaging brand identity and enhancing the overall user interaction.

Final designs

Intuit's 'Thyme' app is designed to provide a visually motivating yet educational introduction to budgeting for high school, college students, and recent graduates. What sets Thyme apart from current popular apps today is its integration with Intuit Assist, Intuit's AI system, to tailor the user experience. The AI continually refines its knowledge to offer improved, personalized budgeting suggestions by learning from its users. The app also incorporates gamification elements, such as virtual gardens, mini quizzes, and offers incentives for motivation, demonstrating a commitment to individual needs. This personalized approach enhances user engagement and creates future customers for Intuit.

Onboarding

Once the user opens the Thyme app, they are immediately greeted by Penny, our budget-saving mascot! Penny is then there to guide the user through the introduction of what they'll expect within the app and the personality + money literacy quizzes.

The user is introduced to the garden concept that the team created to keep them accountable, sticking to their budget ensures a healthy garden. If not, the garden will start to show signs of decay. Users can also personalize their gardens with the flowers they earn after each finished lesson.

The personality and literacy quizzes are encouraged to be taken so that the AI can gain insight into the spending habits the user has to identify their financial personality to personalize the app for them. Then once the user takes the literacy quiz (which they do have the freedom to skip) it allows the AI to place them where they need to be within the courses they could take.

Lesson plans and Ai assistance

After the user has been onboarded, they land on the homepage of the app. From there one of the main features they can access is the lesson plans. The AI will use its knowledge based on the quizzes from the onboarding section or the questions they ask the AI, to recommend the financial lessons the user needs to take.

As the user expands their knowledge, the AI also grows and adjusts accordingly.

Another notable feature is the 'budget creation' function. Once started, the user engages in an activity to craft a budget, guided by their provided income. Penny ensures a thorough explanation throughout the process, helping users comprehend how their money will be allocated through visual elements using envelopes to represent specific expenses.

Widget and resources

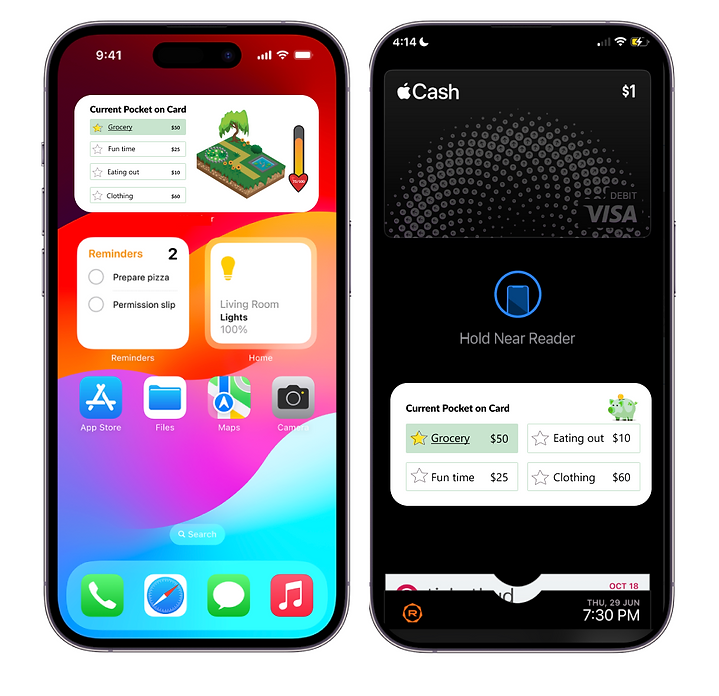

Thyme offers convenient access through a widget placed on the user's homepage or Apple Wallet, allowing easy monitoring of spending habits. Users can create designated "pockets" with a fixed amount of money for specific expenses. This feature empowers users with a constant awareness of their remaining funds for each expense, creating a proactive and informed approach to financial management.

Users can explore a variety of resources by accessing the 'resources' tab in the bottom navigation bar. Deals and discounts featured are tailored to the user's location and university, provided they input their school details. Even for those not currently enrolled, access to local discounts from participating businesses is still available. We see this as a significant incentive for users, offering both convenience and potential savings.

What I learned

-

How to conduct effective user research to understand user needs, behaviors, and preferences.

-

What type of financial personality I am.

-

How to animate with Figma.

-

The importance of balancing work within a team.

-

How to create a professional pitch deck.

-

Utilized our timeline as much as possible because some tasks took longer than expected.

-

How to create a brand identity.

If we had more time

-

Expanding on the financial lessons to show the different levels of learning the user can be in.

-

Show what the app would look like to users who aren't in school.

-

Dive deeper into the island creation feature and what the personalization screen would look like.

-

Collaboration with ADPlist so users have real-life mentors rather than just a robot.

-

Create a community of students and spenders alike so users don't feel lonely on their journey to financial success.

A special thanks <3

A special thank you to my team for being the best team there is. Through the long nights and stress, we were able to remain strong and committed to our work.

Another thank you to our professor Cassini Nazir for giving us this opportunity and motivating us to reach our full potential as designers.

The winning team!